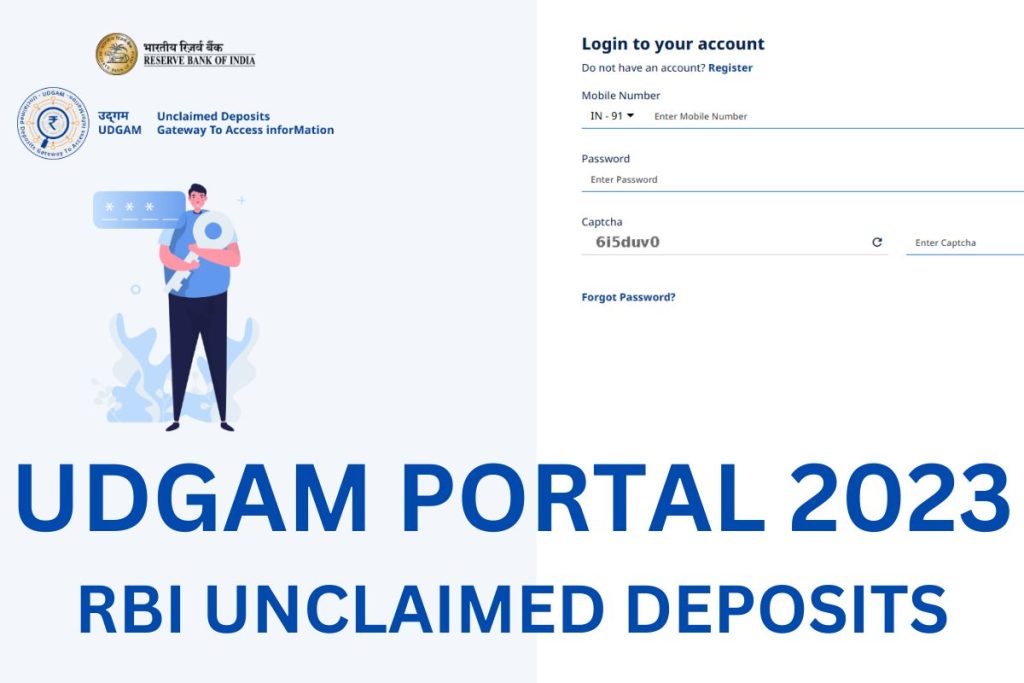

Udgam.Rbi.Org.In – RBI UDGAM Portal 2023 login, Registration, updates and Claim Your Unclaimed Deposit

The Reserve Bank of India (RBI) has recently unveiled the UDGAM Portal 2023 Link as part of its ongoing efforts to address unclaimed deposits. It’s not uncommon for individuals to pass away or cease using their bank accounts, leading to a situation where these accounts remain dormant. In such instances, banks typically wait for a period of 10 years, after which any unclaimed funds are transferred to the Reserve Bank of India.

UDGAM Portal Unclaimed Deposit

If you have a family member with an inactive bank account or Fixed Deposit that hasn’t been utilized for the past decade, you can take advantage of the RBI UDGAM Portal for Unclaimed Deposits. The RBI has launched this UDGAM Application Form 2023, accessible at udgam.rbi.org.in, with the aim of facilitating citizens’ retrieval of approximately Rs 35,000 Crore in unclaimed funds that rightfully belong to them.

Presently, there are seven linked banks participating in this initiative, and more are expected to join in the near future. To determine if you have an account that qualifies for this process, you can easily check on the portal. However, it’s important to note that you must complete the UDGAM Portal Registration at udgam.rbi.org.in before you can access your dormant funds. It’s essential to gather all the necessary information, including UDGAM Portal RBI Registration 2023 and UDGAM RBI Banks Linked, before initiating the registration process.

RBI UDGAM Portal 2023

In a bid to assist individuals in locating forgotten deposits, the Reserve Bank of India (RBI) has introduced a new website. This development follows the announcement of policies for development and regulations on April 6, 2023. The RBI has expressed concern about the substantial number of unclaimed deposits and has undertaken various awareness programs to ensure the public is well-informed. Their primary goal is to ensure that everyone can reclaim their dormant funds, and we are here to provide you with comprehensive information on this matter. We have also created a video guide covering the UDGAM Portal and its registration process.

UDGAM Portal details

Launched in 2023 by the Reserve Bank of India (RBI), the UDGAM Portal (Unclaimed Deposits: Gateway to Access Information) serves as a central repository of information pertaining to unclaimed deposits held by banks in India. An unclaimed deposit refers to an account that has remained inactive for approximately 10 years, with no deposit, withdrawal, or interest transactions during that time. When an account reaches this status, the funds within it are transferred to the RBI, where they are held in a dedicated account known as the Depositor Education and Awareness (DEA) Fund.

The UDGAM Portal provides individuals with the means to search for unclaimed funds associated with their names. To initiate a search, you will need to provide specific details, including:

- Your name

- Date of birth

- PAN number

- Bank account number

If the RBI identifies an unclaimed deposit registered under your name, they will reach out to you with further instructions on how to retrieve the funds. The UDGAM Portal proves to be a valuable resource for individuals who may have overlooked these dormant deposits. If you have not utilized your bank account for an extended period, it is advisable to check the UDGAM portal for any unclaimed funds associated with your account.

UDGAM Portal Funds Reclaim

A newly launched website is set to revolutionize the way people handle forgotten funds in their bank accounts. It offers a user-friendly interface and the opportunity to recover lost funds or reactivate dormant bank accounts through communication with your respective bank. This innovative website is the result of collaborative efforts between several entities, including Reserve Bank Information Technology Pvt Ltd (ReBIT), Indian Financial Technology & Allied Services (IFTAS), and various banks. The primary objective is to simplify financial matters and assist individuals in managing their finances more effectively.

Currently, the UDGAM Portal provides access to information about forgotten funds from seven banks: State Bank of India, Punjab National Bank, South Indian Bank, Central Bank of India, Dhanlaxmi Bank, DBS Bank India, and CitiBank N.A. According to the RBI, additional banks will join this initiative, allowing individuals to search for their dormant funds starting from October 15, 2023. This development is significant as it enhances transparency in financial matters and grants individuals in India greater control over their finances.

UDGAM Portal login process

To embark on the journey of locating your lost savings, simply join the UDGAM platform, which is an effortless process. Provide your phone number, name, and create a password during the initial sign-up. After completing this step, you will receive a verification OTP on your phone. Upon verification, log in to the portal, select your bank, and initiate the search using your PAN, Voter ID, or birthdate.

Important Documents for UDGAM Portal

To ensure a smooth and efficient search process on the UDGAM portal, it’s crucial to have the following documents readily available:

- Mobile Number: For initial registration, verification, and receiving OTPs (One-Time Passwords).

- Name of the Account Holder: Ensuring an exact match with bank records is essential for accurate search results.

- Bank Details: Information regarding the bank or banks where you suspect unclaimed deposits may exist.

- PAN (Permanent Account Number): A vital identification criterion for searching unclaimed deposits.

- Voter ID: An alternative identification option for users seeking to locate dormant funds.

- Driving License Number: Another valid identification method for those searching for their unclaimed funds.

- Passport Number: Useful for individuals who may have used their passport as proof of identity during the initial deposit or account creation.

- Date of Birth: Essential for cross-verifying the account holder’s identity and matching it with bank records.

Having these documents on hand will streamline the search process and ensure that you can efficiently access the UDGAM portal to reclaim your dormant funds.

Download App

Download App

Facebook

Facebook